Investing in bitcoin can be very profitable. But, to get the most out of it, you need to know how to boost bitcoin yield.

With the right tips and expert advice, you can get higher bitcoin yields. This way, you can maximize your investment’s potential.

The cryptocurrency market is always changing. It’s crucial for investors to keep up with the latest strategies for better returns.

Key Takeaways about bitcoin yield

- Understand the concept of bitcoin yield and its importance.

- Learn expert strategies for maximizing returns.

- Discover how to unlock higher bitcoin yields.

- Stay informed about the latest market trends.

- Make informed investment decisions with expert advice.

The Current State of Bitcoin Yields

Investors want to get the most from their money. Knowing about bitcoin yields is key. Yield means the money you make from holding or investing in bitcoin.

What Defines a Bitcoin Yield

A bitcoin yield comes from different ways to invest, like lending or staking. Understanding the risks is crucial for success.

Experts say, “It’s not just about making money. It’s about managing risk and improving your investment mix.”

“The future of bitcoin yield is closely tied to the development of DeFi and the overall adoption of cryptocurrency,”

Average Returns in Today’s Market

Bitcoin yield returns vary based on the strategy and market. Investors can see returns from 4% to 12% a year. But remember, these figures can change with market ups and downs.

Comparing Bitcoin Yields to Traditional Investments

Bitcoin yields often beat traditional investments in returns. But, they also come with more risks. Bonds and savings accounts usually offer 1% to 5% returns.

Bitcoin’s big advantage is its potential for high returns, but be aware of the risks.

In summary, knowing about bitcoin yields is important for investors.

By understanding what they are, their average returns, and how they compare, investors can make better choices.

Understanding bitcoin yieldFundamentals

The cryptocurrency market is always changing. Knowing about Bitcoin yield is key for making smart investment choices.

It’s important to understand the basics to move through the complex world of crypto investments.

Passive vs. Active bitcoin yield Strategies

Investors have two main choices: passive and active yield strategies. Passive strategies need little effort. They use set protocols or platforms to manage the yield process.

Active strategies, however, require more work. Investors must keep an eye on and adjust their portfolios often.

Passive yield strategies are simple and safer. They often involve lending or staking Bitcoin through trusted platforms. These platforms handle the yield generation.

Active yield strategies might offer better returns but are riskier. They need a good grasp of market trends.

The Risk-Return Spectrum

The risk-return spectrum is crucial for investors. Usually, higher returns mean higher risks. Knowing this helps investors choose wisely based on their risk level and goals.

Liquidity Considerations

Liquidity is also important. It’s about how easily you can turn your Bitcoin yield into cash or other assets. High liquidity means more flexibility.

Understanding Bitcoin yield basics is essential. It includes knowing the difference between passive and active strategies, the risk-return spectrum, and liquidity.

This knowledge helps investors pick the right strategy for their goals and risk level.

Top bitcoin yield Platforms in 2023

In 2023, investors have many choices for Bitcoin yield platforms. Both CeFi and DeFi options are available. Each offers different benefits for various investment strategies and risk levels.

Centralized Finance (CeFi) Options

CeFi platforms are more traditional and easier to use. They provide services like lending and borrowing. Their interfaces are user-friendly.

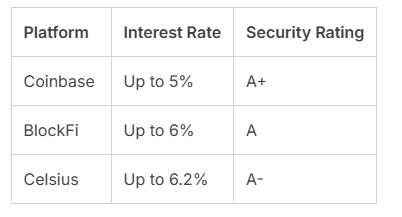

Coinbase, BlockFi, and Celsius

Coinbase, BlockFi, and Celsius lead in CeFi. They offer good interest rates on Bitcoin and more financial services. Coinbase is known for its strong security.

BlockFi has high-yield savings accounts. Celsius offers competitive loan options.

Decentralized Finance (DeFi) Alternatives

DeFi platforms use blockchain technology. They offer decentralized lending and borrowing. They often have higher yields but come with unique risks.

Aave, Compound, and Curve

Aave, Compound, and Curve are key DeFi platforms. Aave is known for its flash loan feature. Compound is famous for its lending protocol.

Curve focuses on stablecoin liquidity pools. These platforms offer good yields but require a good grasp of the technology and risks.

Security Ratings and Insurance Coverage

When picking a Bitcoin yield platform, look at their security ratings and insurance coverage. High security ratings and good insurance coverage add protection. Some platforms have insurance for losses from hacks or security breaches.

In conclusion, CeFi and DeFi platforms have their own benefits. They meet different investor needs. Knowing their strengths and weaknesses helps investors choose the best place for their Bitcoin.

Staking as a Bitcoin Yield Strategy

Staking has become a key way to earn Bitcoin yields in the crypto world. It lets investors get rewards by helping validate blockchain transactions. This is done indirectly for Bitcoin.

Indirect Bitcoin Staking Methods

Bitcoin uses proof-of-work (PoW), not staking like proof-of-stake (PoS) blockchains. Yet, indirect bitcoin staking is now possible through different platforms and methods.

One way is using DeFi platforms. These platforms let users stake wrapped Bitcoin (WBTC) or other Bitcoin-pegged assets. This way, Bitcoin holders can stake without changing their BTC to another crypto.

Wrapped bitcoin yield (WBTC) Opportunities

Wrapped Bitcoin (WBTC) is an ERC-20 token that’s 1:1 backed by Bitcoin. It lets users use Bitcoin in DeFi apps on the Ethereum network. WBTC holders can stake their tokens on DeFi platforms to earn yield.

Step-by-Step Staking Process

- Get WBTC from a trusted exchange or DeFi platform.

- Move WBTC to a DeFi staking platform that works with it.

- Pick a staking pool or validator node.

- Stake your WBTC and start earning rewards.

Validator Node Participation

For a more direct role in staking, running a validator node on a PoS network is an option. It needs technical know-how and a big initial investment.

But, it can bring in big rewards.

The yields differ a lot based on the staking method. Investors should think about their risk level and goals before choosing.

Maximizing bitcoin yield Through Lending

Bitcoin lending platforms have grown, offering new ways to earn. Investors are now looking at lending as a way to boost their returns.

Peer-to-Peer Lending Platforms

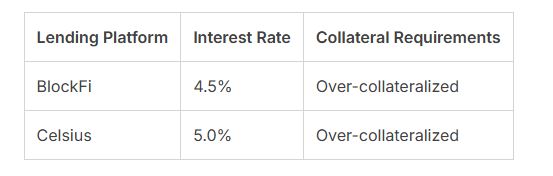

Peer-to-peer lending lets investors lend Bitcoin directly to others. This can offer better interest rates than banks. Sites like BlockFi and Celsius are popular for their safe and clear lending services.

Institutional Lending Programs

Institutional lending is another way to earn Bitcoin. It involves lending to big players like hedge funds. These programs need a lot of money to start.

Collateralization Strategies

Using collateral is key to avoid losses in lending. Investors can use strategies like over-collateralization to lower risk.

Avoiding Liquidation Risks

Liquidation risks are big in lending, especially when values change. To stay safe, investors need enough collateral and keep an eye on the market.

“The key to successful lending is not just about maximizing yields, but also about managing risks effectively.”

Understanding lending and using smart strategies can help investors get the most from their Bitcoin. This way, they can earn more while keeping risks low.

Advanced bitcoin yield Farming Techniques

Bitcoin yield farming has grown more complex, with many strategies for investors. It’s key to grasp these advanced methods to boost returns.

Liquidity Provision Strategies

Liquidity provision is vital in yield farming. Investors can earn big by adding liquidity to DEXs and other platforms. Choosing the right assets, managing risks, and optimizing pool allocations are crucial.

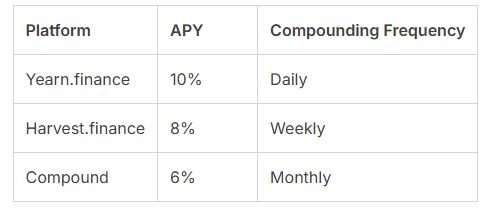

Yield Aggregators and Optimizers

Yield aggregators and optimizers make farming easier. They automatically pick the best opportunities, increasing returns and reducing risks. Yearn.finance and Harvest.finance are top choices.

Compound Yield and APY Calculation

It’s important to know about compound yield and APY. Compound yield is interest on both the principal and any accrued interest.

APY shows the total interest over a year, including compounding.

Automation Tools for Yield Farming

Automation tools are changing yield farming. They let investors run complex strategies without manual effort. These tools handle tasks like rebalancing, harvesting, and gas fee optimization.

Using these advanced methods, investors can fine-tune their Bitcoin yield farming. This helps maximize returns and cut down on risks.

Expert Strategies to Boost Your Bitcoin Yield

To boost your bitcoin yield, you need smart investment moves and to keep up with market trends. Using expert strategies can help you earn more while keeping risks low.

Dollar-Cost Averaging for Yield Generation

Dollar-cost averaging is a proven strategy to handle market ups and downs. By investing the same amount regularly, you can buy more units when prices are low. This can lead to higher yields over time.

Timing Market Cycles

Timing the market means entering and leaving at the right times. It needs a good grasp of market trends. This can be a key to getting the most out of your investments.

Leveraging Bitcoin Options and Futures

Bitcoin options and futures are advanced tools for making more money. They let investors protect their investments or bet on price changes. This can increase their earnings.

Risk Management with Derivatives

Derivatives can boost returns but also add risks. It’s vital to manage these risks well. This means setting limits and using stop-loss orders to prevent big losses.

By using these strategies together, investors can improve their bitcoin yield. It’s important to stay updated and adjust to market changes for lasting success.

Risk Management for Higher Bitcoin Yields

To get the most from Bitcoin, investors face many risks. It’s key to manage these risks well. This helps protect your money and can lead to better returns.

Read Next: How to scan bitcoin qr code in 3 Steps

Smart Contract and Protocol Risks

Smart contracts and protocols are big risks for Bitcoin investors. Smart contract risks can cause financial losses. This is due to bugs, security breaches, or bad actors.

To lower these risks, investors should:

- Check smart contracts carefully before investing.

- Pick protocols known for their security.

- Spread investments across different platforms.

Market Volatility Considerations

Bitcoin’s market is very volatile. This can greatly affect how much you earn. Investors need to be ready for sudden market changes.

Ways to handle market volatility include:

- Using dollar-cost averaging to lessen market effects.

- Setting stop-loss orders to cap losses.

- Regularly updating and adjusting your investment mix.

Insurance and Hedging Strategies

Investors can use insurance and hedging strategies to protect their Bitcoin earnings. These strategies can act as a safety net against losses.

Some common strategies include:

- Using decentralized insurance to cover losses.

- Using hedging tools like options or futures contracts.

- Spreading investments to reduce risk.

Creating a Risk Assessment Framework

To manage risks well, investors need a solid risk assessment framework. This means spotting risks, figuring out their impact, and finding ways to lessen them.

A good framework should have:

- Keeping an eye on market conditions and protocol security.

- Regularly checking how your investments are doing.

- Being ready to adapt to market changes.

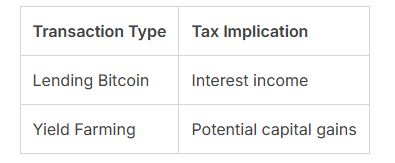

Tax Implications of Bitcoin Yield Strategies

Bitcoin yield strategies are becoming more popular. But, tax considerations are now key when making investment choices. It’s important to know the tax implications to follow the law and get the most out of your investment.

U.S. Tax Considerations for Yield Generation

The IRS sees Bitcoin as property for tax purposes. This means that making money from Bitcoin can lead to taxes.

Activities like lending Bitcoin or yield farming can result in income that needs to be reported on tax returns. Knowing these tax rules helps avoid fines.

Record-Keeping Best Practices

Keeping detailed records of Bitcoin transactions is crucial. You should note the date, time, amount, and value of each transaction. Good record-keeping ensures you report income and capital gains correctly.

Working with Crypto-Savvy Tax Professionals

Understanding cryptocurrency taxes can be tough. Working with tax experts who know about crypto can help. They can guide you on tax rules and help you save on taxes.

A tax expert says, “Understanding cryptocurrency taxes needs special knowledge to follow the law and get the most out of your investment.”

The Future of Bitcoin Yield Opportunities

The future of Bitcoin yield opportunities is being shaped by new technologies. As the ecosystem grows, more ways to earn yield are appearing. This gives investors more choices.

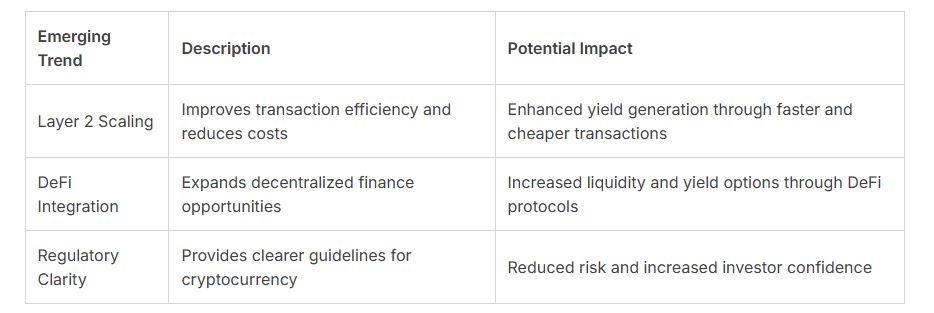

Emerging Protocols and Technologies

New protocols are being developed to make Bitcoin yield generation better. These include advancements in decentralized finance (DeFi) and layer 2 scaling solutions.

Regulatory Developments and Their Impact

Regulatory changes are also important for Bitcoin yield opportunities. As governments and regulatory bodies clarify their stance, the landscape is becoming clearer.

Preparing for the Next Generation of Yield Products

To take advantage of the next generation of yield products, investors need to stay informed.

They should understand the impact of regulatory changes and be ready to adapt to new opportunities.

Conclusion: Building Your Personalized Bitcoin Yield Strategy

Creating a personalized bitcoin yield strategy needs a deep understanding of your investment goals and risk tolerance.

By looking at the strategies in this article, you can make a plan that fits you. This plan will help you get the most from your bitcoin.

First, think about what you want to achieve. Do you want to grow your money over time or make quick profits?

Your goals will show you the best strategy. Then, consider how much risk you can handle. Do you want to take on more risk for bigger rewards, or stick to safer options?

Matching your investment plan with your goals and risk level is crucial. This way, you can move through the bitcoin yield world effectively.

Whether it’s through staking, lending, or yield farming, a good plan will help you reach your financial dreams.

In the end, a personalized bitcoin yield strategy is essential for making the most of your bitcoin. Keep up with the latest, stay flexible, and keep improving your strategy. This will help you get the best returns.

FAQ

What is bitcoin yield, and how is it generated?

Bitcoin yield is the profit from investing in bitcoin. It comes from lending, staking, and yield farming. You can earn interest on loans, staking rewards, or by providing liquidity.

What are the differences between CeFi and DeFi bitcoin yield platforms?

CeFi platforms, like Coinbase and BlockFi, offer traditional services with a central authority. DeFi platforms, such as Aave and Compound, use blockchain for decentralized lending and borrowing.

How do I choose the best bitcoin yield platform for my investment goals?

Look at security ratings, insurance, interest rates, and the platform’s reputation. Think about your risk tolerance and goals to find the right platform.

What are the risks associated with bitcoin yield investments?

Risks include market volatility, smart contract issues, and protocol risks. Understanding these risks and using strategies like diversification can help manage them.

How do tax implications affect bitcoin yield strategies?

Taxes can greatly affect your returns. You need to know U.S. tax rules, keep accurate records, and might need a tax expert. This ensures you follow the law and get the most from your investments.

What is the role of dollar-cost averaging in bitcoin yield generation?

Dollar-cost averaging means investing a set amount regularly, no matter the market. It helps smooth out market ups and downs, leading to more consistent returns.

How can I stay ahead of the curve in the evolving bitcoin yield landscape?

Keep up with new protocols, regulations, and yield products. Being informed and adaptable helps you find new opportunities and stay competitive.

What are the benefits of using automation tools in bitcoin yield farming?

Automation tools streamline yield farming by automatically managing assets and maximizing returns. They save time and simplify the process, letting you focus on your strategy.

Read More: DeFi Yield Farming Strategies: Maximizing Returns and Minimizing Risks