Should I buy bitcoin now because cryptocurrency market has caught the eye of many investors. Bitcoin leads this digital revolution. Bitcoin investment is both fascinating and daunting for those thinking of buying.

It’s important to know the good and bad sides of investing in Bitcoin. This knowledge helps in making a smart choice.

Some see it as a chance to make money, while others are worried about its ups and downs.

Key Takeaways

- Assess the current state of the Cryptocurrency market.

- Understand the pros and cons of Bitcoin investment.

- Consider the volatility of the cryptocurrency.

- Evaluate your financial goals and risk tolerance.

- Research and stay updated on market trends.

Understanding Bitcoin: A Brief Overview

To get into cryptocurrency investment, knowing Bitcoin is key. Bitcoin is more than a digital currency. It’s a new financial system that doesn’t rely on banks or governments.

What Makes Bitcoin Different from Traditional Currencies

Bitcoin stands out because it’s decentralized. This means you can send money directly to others without middlemen. Thanks to blockchain technology, all transactions are open, safe, and can’t be changed.

Also, Bitcoin has a limited supply of 21 million units. This prevents inflation and keeps its value steady over time.

The History and Evolution of Bitcoin

Bitcoin started in 2009 by someone named Satoshi Nakamoto. It began with small transactions but soon became a popular investment. Bitcoin’s price has seen ups and downs, but it’s now a big name in the cryptocurrency market.

Bitcoin’s growth is also tied to tech improvements. Better trading platforms and security have helped it grow. Knowing Bitcoin’s history and value drivers is crucial for investors.

The Current State of the Bitcoin Market

Looking at the Bitcoin market today, we see some important trends. The world of cryptocurrencies is very changeable. Bitcoin price trends are especially important for those who invest.

Recent Price Trends and Market Capitalization

Bitcoin’s price has gone up and down a lot in the last year. Its market capitalization has also grown a lot. This shows how big Bitcoin is in the cryptocurrency market.

Bitcoin’s price has been both steady and unpredictable. It’s affected by things like new rules, how people use it, and the world economy. Investors are watching these changes to decide when to buy or sell.

Bitcoin’s Position in the Broader Cryptocurrency Ecosystem

Bitcoin is still the top dog in the cryptocurrency ecosystem. It’s way ahead of other cryptocurrencies in market capitalization. This makes it a key player in the industry.

Other cryptocurrencies, or altcoins, are trying to catch up.

But Bitcoin’s early start, wide use, and strong network keep it on top. As the market changes, Bitcoin’s ability to keep up and improve will be key to staying ahead.

Should I Buy Bitcoin Now? Analyzing Market Timing

Understanding the current Bitcoin market is key to deciding if now is the right time to invest. Market timing plays a big role, influenced by historical price trends and market indicators.

“The key to making a profitable investment in Bitcoin lies in understanding its cyclical nature,” notes a renowned cryptocurrency analyst.

Bitcoin’s price has historically followed a cyclical pattern, with periods of significant growth followed by corrections.

The Cyclical Nature of Bitcoin Prices

Bitcoin’s price cycles are driven by many factors. These include market sentiment, regulatory news, and macroeconomic trends.

For example, the 2017 Bitcoin boom was followed by a prolonged bear market, showing its cyclical nature.

Indicators That May Suggest Good Entry Points

Several indicators can help investors find good entry points in the Bitcoin market. These include technical analysis indicators like the Relative Strength Index (RSI) and moving averages.

They signal when Bitcoin is oversold or undervalued.

Also, fundamental analysis is important. It looks at adoption rates, network congestion, and developer activity. This gives insights into Bitcoin’s long-term potential.

“Investing in Bitcoin requires a deep understanding of both its technical and fundamental aspects,”

This highlights the need for a thorough analysis.

By analyzing these indicators and understanding Bitcoin’s cyclical nature, investors can make better decisions. They can decide if now is a good time to buy Bitcoin.

Potential Benefits of Bitcoin Investment

Bitcoin is a unique asset class that offers many benefits. It’s different from traditional investments. Knowing these benefits is key to making smart investment choices.

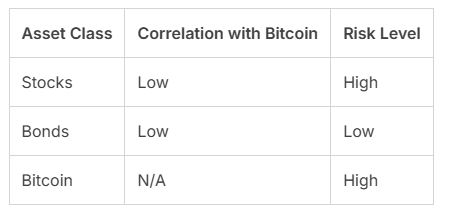

Portfolio Diversification Advantages

Investing in Bitcoin can diversify your portfolio. It helps reduce risk by adding something new to your mix. Bitcoin’s performance isn’t tied to other assets, making it great for spreading out your investments.

Hedge Against Inflation and Currency Devaluation

Bitcoin is seen as a digital store of value like gold. Its limited supply and decentralized nature make it a good hedge against inflation and currency loss.

As more money is printed, Bitcoin’s value might go up, protecting against economic risks.

Technological Innovation and Future Potential

Investing in Bitcoin means investing in blockchain technology. This technology has big implications for many industries. It could change finance, supply chain management, and healthcare, making Bitcoin more than just a currency.

In conclusion, Bitcoin offers many benefits. It helps diversify your portfolio, protects against economic risks, and invests in technology. Always do your research and think about your financial goals before investing in Bitcoin.

Risks and Challenges of Bitcoin Investment

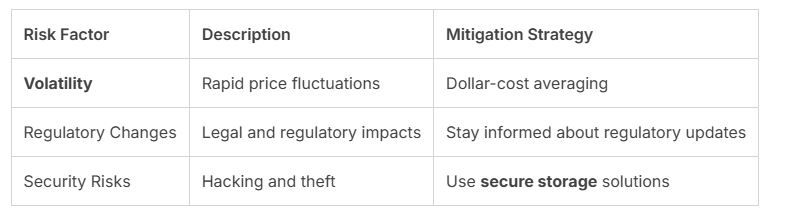

Investing in Bitcoin comes with several challenges. The chance for high returns is tempting, but knowing the risks is key. This knowledge helps investors make smart choices.

Volatility and Price Uncertainty

Bitcoin’s price can change quickly, sometimes in just hours. This unpredictability can lead to big gains or losses. Investors should be ready for the possibility of a sharp drop in value.

Regulatory Concerns and Legal Considerations

The rules for cryptocurrencies are always changing. New laws or regulations can affect Bitcoin’s value and use. It’s important for investors to keep up with these changes.

Security Risks and Storage Challenges

Keeping Bitcoin safe is a big concern. There’s always a risk of hacking and theft, especially if storage isn’t secure. Learning how to protect your Bitcoin is crucial.

To better understand the risks, consider the following comparison of risk factors:

In conclusion, Bitcoin offers investment chances, but it’s important to know the risks. By understanding these challenges and taking steps to reduce them, investors can make better choices.

Bitcoin as Part of Your Investment Strategy

Adding Bitcoin to your investment plan can be smart. It mixes risk with the chance for big rewards. As the world of cryptocurrency grows, knowing how to use Bitcoin wisely is key.

Bitcoin’s Role in a Diversified Portfolio

A well-diversified portfolio spreads out investments to lower risk. Bitcoin can help diversify by offering a different kind of investment. It might protect against the ups and downs of traditional markets.

But, it’s important to weigh Bitcoin’s benefits against its risks. Its price can swing a lot.

When deciding how much Bitcoin to include, think about your financial goals and how much risk you can handle.

Read Next: Discover the Car dealerships that accept bitcoin near me

Short-term vs. Long-term Investment Approaches

Investors can choose between short-term and long-term Bitcoin strategies. Short-term strategies mean trading Bitcoin to make quick profits. But, this can be risky because of the market’s unpredictability.

A long-term approach means holding Bitcoin for a longer time. This could lead to bigger gains over time.

Each strategy has its pros and cons. The right choice depends on your financial goals, how much risk you’re willing to take, and how long you plan to invest.

How Much Bitcoin Should You Consider Buying?

The amount of Bitcoin you should buy depends on several factors. These include your financial goals and risk tolerance. It’s important to assess your overall financial situation and investment strategy before making a decision.

Determining Your Risk Tolerance

Understanding your risk tolerance is key when deciding how much Bitcoin to buy. If you’re risk-averse, a smaller investment might be better. If you’re okay with higher risk, you could invest more.

Your risk tolerance should match your financial goals and overall investment portfolio.

Dollar-Cost Averaging vs. Lump Sum Investment

Investors often debate between dollar-cost averaging and lump sum investment strategies. Dollar-cost averaging means investing a fixed amount regularly, no matter the market.

This can help smooth out volatility. On the other hand, a lump sum investment puts more money into Bitcoin at once. It’s riskier but could lead to higher returns if the market does well.

Setting Investment Goals and Timeframes

Setting clear investment goals and timeframes is crucial. Are you aiming for short-term gains or long-term growth? Your goals will help decide how much to invest.

Also, consider your time horizon, as it affects your ability to handle market changes.

Practical Steps to decision of should i buy bitcoin now

Buying Bitcoin requires several important steps. You need to pick the right exchange and keep your investment safe. Knowing these steps well is key for a smooth buy.

Choosing a Reputable Exchange

Finding a trustworthy cryptocurrency exchange is the first step. Look for exchanges known for their security, clear fees, and good reputation. Coinbase, Binance, and Kraken are well-known options.

When picking an exchange, think about how easy it is to use, the support you get, and what you can trade.

- Research the exchange’s security record

- Check for regulatory compliance

- Evaluate the user interface and experience

Setting Up Secure Storage Solutions

After buying Bitcoin, keeping it safe is crucial. Use a hardware wallet like Ledger or Trezor for better security than software wallets. Always back up your wallet’s recovery phrase and keep it somewhere safe.

Key considerations for secure storage:

- Use a reputable hardware wallet

- Enable two-factor authentication

- Regularly update your wallet software

Understanding Fees and Costs of should i buy bitcoin now

Buying Bitcoin comes with different fees. These include transaction fees, exchange fees, and withdrawal fees. Know the fees of your exchange and wallet to save money. Some exchanges give discounts for big traders or for using their tokens.

Tips for reducing costs:

- Compare fees across different exchanges

- Consider using limit orders instead of market orders

- Monitor network congestion to optimize transaction timing

Tax Implications for Bitcoin Investors in the United States

It’s key for U.S. investors to grasp the tax rules of Bitcoin. The IRS views Bitcoin as property for tax purposes. This has big implications for how it’s taxed.

IRS Classification and Reporting Requirements

The IRS sees Bitcoin as property, not money. This means capital gains tax kicks in for Bitcoin deals.

Investors must report their gains and losses on tax forms, like Form 8949 and Schedule D.

Keeping detailed records is vital to follow these rules.

Strategies for Tax-Efficient Bitcoin Investing

To cut down on taxes, investors can use a few tactics. One method is tax-loss harvesting. This involves selling losing assets to balance out gains from other investments.

Another way is to hold Bitcoin for over a year. This makes it eligible for long-term capital gains. These gains are taxed at a lower rate than short-term ones.

By knowing the tax rules and using smart strategies, Bitcoin investors can boost their returns. They also make sure they follow IRS rules.

Conclusion: Making an Informed Decision About Bitcoin Investment should i buy bitcoin now

Thinking about buying Bitcoin now? You need to look at many things, like market trends and risks. This article has covered Bitcoin’s details, its place in the crypto world, and its role in a mixed investment portfolio.

Before investing in Bitcoin, think about the good and bad sides. Bitcoin can protect against inflation and add variety to your investments. But, it’s also known for its ups and downs, unclear rules, and safety concerns.

Wondering if you should buy Bitcoin now? Think about how much risk you can handle, your investment goals, and how long you can wait.

Keeping up with market news and adjusting your plan is key. This way, you can handle Bitcoin’s challenges and maybe find some benefits.

FAQ

What is Bitcoin and how does it work?

Bitcoin is a digital currency that doesn’t need banks. It uses a network where people can send money directly to each other. This makes transactions safe and clear.

Is it a good time to buy Bitcoin?

Deciding to buy Bitcoin depends on many things. You should look at market trends, your goals, and how much risk you can take. Always do your homework before investing.

How do I store my Bitcoin securely?

To keep your Bitcoin safe, use a trusted hardware wallet like Ledger or Trezor. Or, choose a secure software wallet, such as Electrum. Always protect your private keys and never share them.

What are the tax implications of investing in Bitcoin in the United States?

In the U.S., Bitcoin is seen as property. This means you’ll pay capital gains tax on profits or losses. It’s important to know how to report this and use tax-smart strategies.

Can I buy a fraction of a Bitcoin?

Yes, you can buy just a part of a Bitcoin. Bitcoin can be split up to eight decimal places. So, you can buy as little as 0.00000001 BTC, or 1 Satoshi.

How do I choose a reputable Bitcoin exchange?

When picking a Bitcoin exchange, look at security, fees, how easy it is to trade, and what others say. Choose exchanges that follow the law and are well-respected in the field.

What is dollar-cost averaging, and how can it help with Bitcoin investment?

Dollar-cost averaging means buying the same amount of Bitcoin at set times, no matter the price. This method can lessen the effects of price changes and timing risks.

How does Bitcoin’s price volatility affect my investment?

Should i buy bitcoin now because Bitcoin’s price can change a lot, leading to big gains or losses. Remember, investing in Bitcoin is risky. Be ready for price changes.