Investing in cryptocurrency bitcoin depot stock is getting more popular. Bitcoin Depot is making it easier. It’s important to understand the potential of companies like Bitcoin Depot in the cryptocurrency investment world.

Bitcoin ATMs are popping up all over the United States. Companies like Bitcoin Depot are leading the way.

This article will look into the potential of investing in Bitcoin Depot stock. It will also explore how it can help you make profits in crypto.

Key Takeaways

- Understanding the role of Bitcoin Depot in the cryptocurrency market.

- The potential benefits of investing in Bitcoin Depot stock.

- How the rise of Bitcoin ATMs is impacting cryptocurrency investment.

- The importance of considering cryptocurrency investment options.

- Key factors to consider when investing in Bitcoin Depot stock.

What is Bitcoin Depot?

Bitcoin Depot is changing how we use cryptocurrencies. It’s a big name in the digital currency world. People are taking notice of its new way of using digital money.

Company Overview and History

Bitcoin Depot is leading the way in making digital money easy to use. It started with a mission to make cryptocurrencies more accessible. Now, it’s a top player in the field.

The company has hit many important milestones. It’s grown its Bitcoin ATM network across the United States.

Reports show Bitcoin Depot’s customer base is growing fast. More and more people are using its services for their digital money needs.

Bitcoin ATM Network and Operations

Bitcoin Depot has a huge network of Bitcoin ATMs. It’s one of the biggest in the world. This makes it easy for people to buy and sell digital money.

A top cryptocurrency analyst says, “Bitcoin Depot’s ATM network is a game-changer.” It makes it easier for new users to get into digital money.

“The growth of Bitcoin Depot’s ATM network shows more people want cryptocurrency services.”

Cryptocurrency Industry Report

The company makes sure its services are easy to use and safe. This has helped Bitcoin Depot become well-respected in the industry.

The Business Model Behind Bitcoin Depot

To understand Bitcoin Depot’s business model, we need to look at its income sources and growth plans. The company’s setup is made to meet the growing need for crypto transactions. It offers easy and convenient services to users.

Revenue Streams and Monetization Strategy

Bitcoin Depot makes money mainly from its Bitcoin ATM network. It charges fees for each transaction through its machines, found in many stores and businesses.

The revenue model is diversified, helping the company stay profitable even when the market changes. It also looks into other ways to make money, like providing liquidity to crypto exchanges or offering financial services.

The company focuses on using its ATM network to its fullest. It aims to grow its presence in important markets and improve user experience. This way, it hopes to boost transaction numbers and its earnings.

Expansion Plans and Growth Initiatives

Bitcoin Depot is set to grow by adding more ATMs in places where they are needed most. It also wants to offer more services, like new cryptocurrencies and financial products.

The company’s growth is supported by a strong setup and a focus on following the rules. By growing in a way that keeps customers happy, Bitcoin Depot aims to become a key player in the crypto market.

Bitcoin Depot Stock: Performance Analysis

Looking at Bitcoin Depot’s stock shows a mix of growth and ups and downs. As people try to get into the crypto market, knowing how Bitcoin Depot’s stock works is key.

Stock Price History and Key Movements

Bitcoin Depot’s stock price has seen big swings, thanks to the crypto market’s trends. Key movements in the stock price happen when more people start using crypto or when new rules come out.

“The crypto market is very unpredictable, and Bitcoin Depot’s stock is no different,” said a market expert. “Investors must keep up with market trends and new rules.”

Important Financial Indicators

To really understand Bitcoin Depot’s stock, we need to look at key financial signs. These include revenue growth, profit margins, and cash flow.

By checking these, investors can see how well the company is doing and if it might grow more.

- Revenue growth rate

- Net profit margin

- Operating cash flow

These signs give a full picture of Bitcoin Depot’s stock performance. They help investors make smart choices.

Market Position and Competitive Advantage

Bitcoin Depot stands out in the market with its wide ATM network and smart operations. It’s a top name in the Bitcoin ATM world, making a big mark for itself.

Bitcoin ATM Industry Landscape

The Bitcoin ATM world is growing fast as more people use cryptocurrencies. Bitcoin Depot leads this growth with its big network of ATMs. These ATMs make it easy for people to get into cryptocurrencies.

The industry has big players like Bitcoin Depot and smaller ones too. This mix pushes everyone to be creative. Companies compete on fees, how many ATMs they have, and how easy it is for users.

Bitcoin Depot’s Unique Selling Propositions

Bitcoin Depot stands out in several ways:

Extensive ATM Network: It has lots of ATMs in many places. This makes it easy for users to get to cryptocurrencies.

Strategic Partnerships: The company teams up with big retailers and businesses. This helps grow its ATM network.

User-Centric Services: Bitcoin Depot aims to make things easy for users. It has simple interfaces and good fees.

Experts say Bitcoin Depot’s strong market spot shows its smart business plan and forward thinking. This forward-thinking approach helps the company stay on top in the Bitcoin ATM market.

Investment Potential and Growth Opportunities

Bitcoin Depot is a top name in the Bitcoin ATM world. It offers a great chance for investors with big growth chances. The company’s smart moves and growing network are key to its appeal.

Short-term Investment Outlook

Bitcoin Depot looks good for the short term. It’s growing into new areas and more people are using its ATMs. The company is working hard to make its ATMs better and easier to use, which should help its money-making.

Key short-term drivers include:

- Increased demand for cryptocurrency ATMs

- Expansion into new geographical markets

- Enhancements to ATM technology and user interface

- Long-term Growth Projections

The future looks bright for Bitcoin Depot. The growth of the crypto market and the company’s smart moves will help it grow. As more people start using cryptocurrencies, Bitcoin Depot is ready to take advantage of this.

Key long-term growth factors include:

- Increasing mainstream acceptance of cryptocurrencies

- Potential for further expansion into underserved markets

- Advancements in cryptocurrency ATM technology

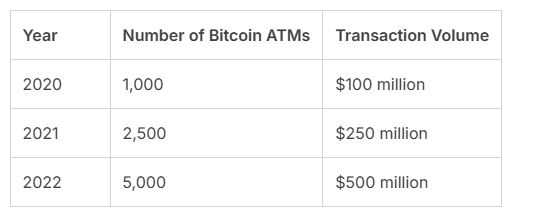

To show the growth potential, let’s look at a table of important financial numbers:

Looking at these numbers helps investors understand Bitcoin Depot’s chances for growth and investment.

Risk Assessment for Bitcoin Depot Investors

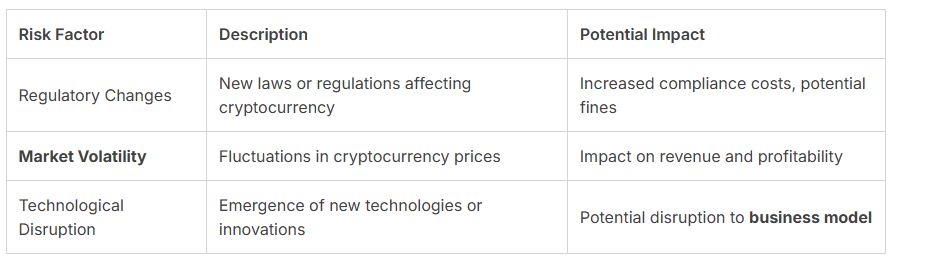

Investing in Bitcoin Depot comes with risks. It’s important to know these risks before deciding to invest. This section will cover the main risks that could affect your investment choices.

Regulatory and Compliance Challenges

Bitcoin Depot faces challenges from changing laws and regulations. These changes can impact how the company operates and makes money.

For example, stricter rules on money laundering and knowing your customers could raise costs.

Read Next: Bitcoin Knots: Unlock the Power of Cryptocurrency

Key Regulatory Risks:

- Changes in cryptocurrency regulations

- Compliance with AML/KYC requirements

- Potential for regulatory fines or penalties

Cryptocurrency Market Volatility Impact

The cryptocurrency market is very volatile. Prices can change quickly. This can affect how much people want to use Bitcoin Depot’s services, which can impact its earnings.

Market volatility can be influenced by various factors, including:

- Global economic trends

- Regulatory announcements

- Technological advancements

- Technological Disruption Risks

The world of cryptocurrency and ATM technology is always changing. New technologies could make Bitcoin Depot’s services less competitive or even outdated.

Bitcoin Depot vs. Other Crypto Investment Options

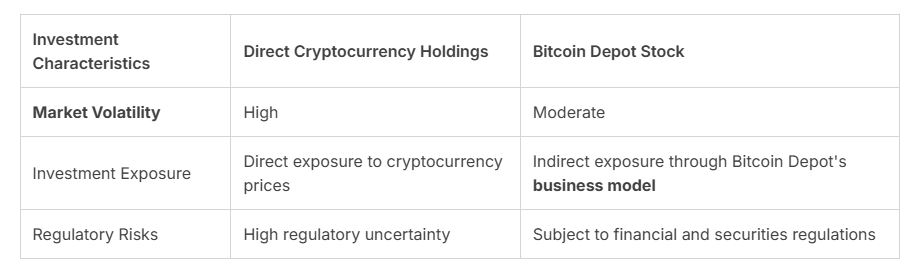

Bitcoin Depot stock is just one of many ways to invest in cryptocurrency. It’s important to compare its performance with other crypto investments. Each option has its own unique features.

Comparison with Direct Cryptocurrency Holdings

Investing in Bitcoin Depot stock is different from holding cryptocurrencies like Bitcoin or Ethereum. Holding cryptocurrencies directly can be risky due to market ups and downs.

On the other hand, Bitcoin Depot stock offers a more stable investment option. Its value is influenced by the company’s performance, not just cryptocurrency prices.

Here is a comparison table highlighting key differences:

Bitcoin Depot vs. Other Crypto-Related Stocks

Bitcoin Depot is not the only stock that lets you invest in cryptocurrency. Other companies, like those in mining or crypto financial services, also offer investment chances.

But Bitcoin Depot stands out because of its large network of Bitcoin ATMs.

As CoinDesk points out, “The cryptocurrency investment landscape is becoming increasingly diverse, offering investors a range of options to gain exposure to this rapidly evolving market.”

“Investors should carefully evaluate the unique characteristics and risks associated with each investment option.”

When comparing Bitcoin Depot stock to other crypto-related stocks, look at the company’s business model, financial health, and growth prospects. This helps investors choose the best option for their financial goals and risk tolerance.

Strategic Approaches to Investing in Bitcoin Depot

To get the most out of Bitcoin Depot, investors need a smart plan. They should know when to invest, how to time it, and how to fit it into their portfolio.

Optimal Entry Points and Timing Strategies

Finding the best time to invest in Bitcoin Depot is key. Investors should look at market trends, like demand for cryptocurrencies, changes in laws, and new tech.

Using dollar-cost averaging can help smooth out price swings.

Timing your investment can also depend on the crypto market’s performance. For example, when the market is calm, it might be a good time to invest.

But when it’s volatile, you might need to rethink or adjust your investment.

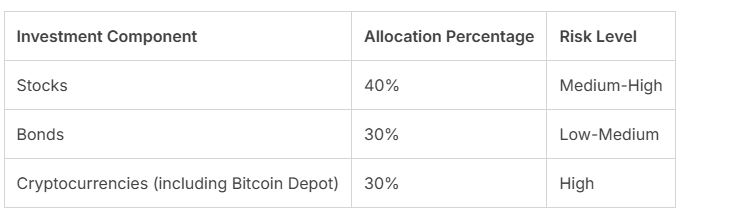

Portfolio Integration and Allocation Advice

Adding Bitcoin Depot to your portfolio needs careful planning. Think about your risk level, goals, and how your assets are spread out.

A balanced portfolio might include stocks, bonds, and cryptocurrencies, with Bitcoin Depot as a special part.

By planning your investment and spreading your assets, you can aim for better returns and lower risks.

Conclusion: Making an Informed Decision on Bitcoin Depot Stock

Investing in Bitcoin Depot stock needs a deep look at the company’s business, market spot, and risks. We’ve covered Bitcoin Depot’s key points, like its business model, income sources, and what sets it apart.

Looking at the stock’s past and future growth helps investors decide if it fits their portfolio. It’s key to balance the good points with the risks of crypto investments.

Choosing to invest in Bitcoin Depot stock means looking at many things. This includes the company’s growth plans, financial health, and the Bitcoin ATM market.

This way, investors can feel more sure about their crypto investment choices.

FAQ

What is Bitcoin Depot?

Bitcoin Depot is a company with a network of Bitcoin ATMs. It lets users buy and sell cryptocurrencies.

How does Bitcoin Depot make money?

It makes money by charging fees for transactions at its ATMs. This includes buying and selling cryptocurrencies.

What are the benefits of investing in Bitcoin Depot stock?

Investing in Bitcoin Depot stock lets you tap into the growing crypto market. It also offers the chance for long-term growth.

What are the risks associated with investing in Bitcoin Depot stock?

Risks include regulatory challenges, market volatility, and technological risks. These can affect the stock’s value.

How does Bitcoin Depot compare to other crypto investment options?

Bitcoin Depot stands out as a unique investment option. It’s different from holding cryptocurrencies directly or investing in other crypto-related stocks.

What are the optimal entry points and timing strategies for investing in Bitcoin Depot?

Investors should look at market trends, financial indicators, and growth forecasts. These help decide the best times to invest.

How can I integrate Bitcoin Depot stock into my investment portfolio?

Think about your financial goals, risk tolerance, and diversification when adding Bitcoin Depot stock. It’s part of a broader investment strategy.

What is the current market position of Bitcoin Depot?

Bitcoin Depot leads in the Bitcoin ATM industry. It has a large network and a strong brand.

How does Bitcoin Depot’s business model contribute to its growth potential?

Its business model, including revenue streams and expansion plans, boosts its growth potential. This makes it attractive for investors.