The question why did bitcoin crash has left many investors wondering what triggered the sudden decline. The cryptocurrency decline has been a topic of discussion among financial experts and enthusiasts alike.

As the value of Bitcoin plummeted, questions arose about the factors contributing to the crash. Understanding the reasons behind this significant event is crucial for investors and those interested in the cryptocurrency market.

Key Takeaways of why did bitcoin crash

- The Bitcoin crash was a sudden and significant decline in value.

- Cryptocurrency markets are known for their volatility.

- Investors are left wondering what triggered the crash.

- Understanding the reasons is crucial for investors.

- The crash has sparked discussions among financial experts.

The Recent Bitcoin Plunge: A Timeline of Events

A closer look at the timeline of events surrounding the recent Bitcoin plunge reveals a complex series of market reactions. The cryptocurrency market is known for its volatility, but the recent question why did bitcoin crash was particularly significant.

Key Dates and Price Movements

The Bitcoin price drop began on April 10th, when the price fell from $65,000 to $55,000 within a few hours. This initial drop was followed by a brief recovery, but the price continued to decline over the next few days.

Initial Market Reactions

The initial market reaction to the Bitcoin price drop was characterized by panic selling. As the price fell, many investors rushed to sell their holdings, further exacerbating the decline.

According to a report by CoinDesk, the liquidation of leveraged positions contributed significantly to the market volatility.

“The rapid decline in Bitcoin’s price caught many investors off guard, leading to a cascade of liquidations that further accelerated the price drop.”

Immediate Aftermath and Stabilization Attempts

In the immediate aftermath of the crash, market participants awaited signals from major investors and regulatory bodies. Some investors saw the price drop as a buying opportunity, while others continued to sell.

The market reactions were mixed, with some expecting a quick recovery and others anticipating further declines.

As the market continues to evolve, understanding the timeline of events surrounding the recent Bitcoin plunge is crucial for investors looking to navigate the volatile cryptocurrency market.

Historical Context: Bitcoin’s Volatile Past

Understanding Bitcoin’s past is crucial, as it has weathered numerous storms, including several major crashes that have shaped its current state.

Bitcoin’s history is a testament to its resilience and the inherent volatility of the cryptocurrency market.

Previous Major Bitcoin Crashes

Bitcoin has experienced several significant crashes throughout its history. Two notable instances are the 2017-2018 bubble and burst, and the 2021 rollercoaster.

The 2017-2018 Bubble and Burst

In 2017, Bitcoin’s price surged to nearly $20,000, driven by speculation and hype. However, this was followed by a sharp decline in 2018, with prices dropping to around $3,000.

This period highlighted the cryptocurrency’s volatility and susceptibility to market sentiment.

The 2021 Rollercoaster

In 2021, Bitcoin experienced another significant price swing, reaching an all-time high of over $64,000 before dropping to around $30,000. This volatility was influenced by factors such as regulatory announcements and changes in market sentiment.

Recovery Patterns After Historical question why did bitcoin crash

Despite the severity of these crashes, Bitcoin has shown an ability to recover. Historical data suggests that after a crash, Bitcoin can enter a period of consolidation before potentially making a new high.

For instance, after the 2018 crash, Bitcoin took nearly two years to reach new highs.

- Consolidation Phase: After a crash, Bitcoin often enters a consolidation phase where the price stabilizes.

- Gradual Recovery: Following consolidation, Bitcoin has historically shown a gradual recovery, driven by renewed investor interest.

- New Highs: In some cases, this recovery has led to new all-time highs, as seen in both 2017 and 2021.

Understanding these patterns can provide valuable insights for investors navigating the volatile cryptocurrency market.

Why Did Bitcoin Crash? The Technical Factors

A multifaceted analysis reveals that several technical factors contributed to the Bitcoin crash. The cryptocurrency market is known for its volatility, and Bitcoin is no exception.

Understanding the technical factors behind the crash is crucial for investors and enthusiasts alike.

Overleveraged Positions and Liquidation Cascades

One of the primary technical factors was the prevalence of overleveraged positions among traders. When Bitcoin’s price began to drop, these traders faced margin calls, leading to a cascade of liquidations that further accelerated the price decline.

This created a feedback loop where falling prices triggered more liquidations, exacerbating the crash.

The use of leverage in cryptocurrency trading amplifies both gains and losses.

As the price of Bitcoin fell, traders who had taken on too much leverage found themselves unable to meet margin requirements, resulting in the forced sale of their assets.

This liquidation cascade played a significant role in the rapid price drop.

Mining Difficulty and Hash Rate Fluctuations

Another technical factor was the adjustment in mining difficulty and fluctuations in the hash rate. Bitcoin’s mining difficulty adjusts every 2016 blocks, or approximately every two weeks, to maintain a consistent block time.

Changes in mining difficulty can impact the security and efficiency of the network, potentially influencing investor confidence.

Fluctuations in the hash rate, which measures the computational power securing the Bitcoin network, can also affect the cryptocurrency’s price.

A significant drop in hash rate can indicate a decrease in network security, potentially leading to investor panic.

Network Congestion and Transaction Issues

Network congestion and transaction issues also played a role in the Bitcoin crash. As the number of transactions on the Bitcoin network increases, so does the congestion, leading to higher transaction fees and longer confirmation times.

This congestion can frustrate users and investors, contributing to a negative market sentiment.

Transaction issues, such as delays in transaction confirmations, can further erode confidence in the network. During times of high volatility, the ability to quickly and efficiently process transactions is crucial.

Any inefficiencies in this process can exacerbate market downturns.

Market Psychology Behind the Crash

Understanding the market psychology behind the Bitcoin crash requires delving into the emotional and behavioural aspects that drove investor decisions.

The question why did bitcoin crash was not just a result of technical factors but was also significantly influenced by the collective psychology of the market.

Read More: When will bitcoin crash again: What You Need to Know

Fear and Greed Index Analysis

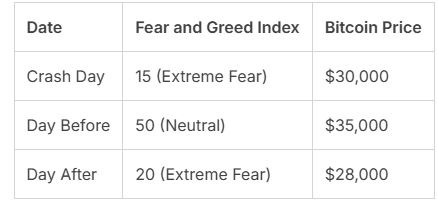

The Fear and Greed Index is a tool used to measure the current sentiment of the Bitcoin market, ranging from 0 (Extreme Fear) to 100 (Extreme Greed).

During the crash, this index plunged to extreme fear levels, indicating that investors were overwhelmingly fearful. This fear was a driving factor behind the panic selling that further exacerbated the price drop.

why did bitcoin crash

Social Media Influence on Crypto Markets

Social media platforms like Twitter and Reddit played a crucial role in shaping market sentiment during the crash. Influencers and community discussions can rapidly shift sentiment, leading to significant price movements.

The Elon Musk Effect

Elon Musk’s tweets have historically had a significant impact on Bitcoin prices.

During the crash, his comments were closely watched, and any negative sentiment was quickly amplified across social media, contributing to the downward pressure on prices.

Reddit and Twitter Sentiment Shifts

On platforms like Reddit’s r/Bitcoin and Twitter, the sentiment shifted rapidly from bullish to bearish as the crash unfolded. The spread of negative news and FUD (Fear, Uncertainty, and Doubt) further fueled the panic selling.

Retail Investor Panic Selling

Retail investors were among the most affected by the crash, with many engaging in panic selling as prices plummeted. This selling further accelerated the price drop, creating a vicious cycle of fear and selling.

The interplay between market psychology, social media, and investor behavior created a perfect storm that exacerbated the Bitcoin crash. Understanding these dynamics is crucial for investors to navigate the volatile cryptocurrency market.

Regulatory Pressures and Their Impact on this question why did bitcoin crash

As regulatory environments evolve, their impact on cryptocurrencies like Bitcoin becomes more pronounced, as evident in the recent crash.

The interplay between government regulations, central bank policies, and tax implications has created a complex landscape that significantly affects Bitcoin’s value.

Recent Government Regulations Affecting Crypto

Government regulations have been a major driver of change in the cryptocurrency market. Recent developments in both the U.S. and international regulatory landscapes have had a profound impact on Bitcoin.

U.S. Regulatory Developments

In the United States, regulatory bodies have been actively shaping the cryptocurrency landscape.

The Securities and Exchange Commission (SEC) has been particularly vigilant, scrutinizing crypto exchanges and initial coin offerings (ICOs) to ensure compliance with securities laws. Recent guidance has clarified the regulatory status of various cryptocurrencies, affecting their market value.

International Regulatory Changes

Globally, countries have adopted varying approaches to cryptocurrency regulation. Some nations have embraced cryptocurrencies with favorable regulations, while others have imposed strict controls or outright bans.

For instance, countries like Japan and Switzerland have established clear regulatory frameworks, whereas China has taken a more restrictive stance.

Central Bank Policies and Statements

Central banks around the world have also played a crucial role in shaping the cryptocurrency market through their policies and public statements. Their actions and comments on digital currencies can significantly influence market sentiment.

For example, when central banks discuss the potential for central bank digital currencies (CBDCs), it can impact investor confidence in existing cryptocurrencies like Bitcoin.

Tax Implications and Enforcement Actions

Tax authorities have been increasingly focused on cryptocurrency transactions, clarifying tax obligations and enforcing compliance.

The IRS, for instance, has issued guidelines requiring taxpayers to report cryptocurrency gains and losses.

Enforcement actions against tax evasion have become more common, adding another layer of regulatory pressure on cryptocurrency holders.

The cumulative effect of these regulatory pressures has contributed to the recent question why did bitcoin crash.

Understanding these factors is crucial for investors and market participants to navigate the complex and evolving cryptocurrency landscape.

Macroeconomic Factors Influencing Bitcoin’s Value

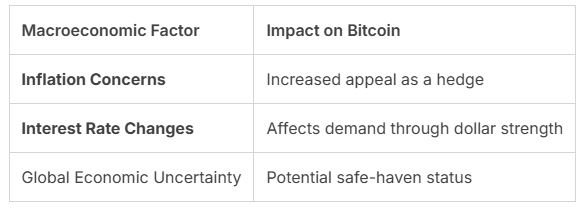

Bitcoin’s value is significantly affected by broader economic trends, including inflation, interest rates, and global economic uncertainty.

Understanding these macroeconomic factors is crucial for investors and analysts seeking to grasp the dynamics driving Bitcoin’s price.

Inflation Concerns and Bitcoin as a Hedge

Inflation concerns have been on the rise, prompting investors to seek hedges against potential currency devaluation. Bitcoin, with its limited supply, is often considered a potential hedge against inflation.

As inflation concerns grow, the appeal of Bitcoin as a store of value increases. Investors looking to protect their wealth may turn to Bitcoin, driving up its price.

Interest Rate Changes and Crypto Markets

Changes in interest rates can significantly impact the cryptocurrency market.

Higher interest rates can strengthen the dollar, making Bitcoin more expensive for foreign investors, potentially dampening demand. Conversely, lower interest rates can weaken the dollar, potentially boosting Bitcoin’s appeal.

Global Economic Uncertainty and Safe Haven Assets

During times of global economic uncertainty, investors often seek safe-haven assets. Bitcoin’s decentralized nature and limited supply have led some to consider it a safe-haven asset, similar to gold.

However, its volatility means it doesn’t always behave as expected during economic downturns.

Institutional Players: Their Role in the Bitcoin Crash

The Bitcoin crash has highlighted the significant influence of institutional players on cryptocurrency markets. As the value of Bitcoin plummeted, the actions of these major investors came under intense scrutiny.

Major Corporate Holders and Their Actions

Major corporate holders, such as MicroStrategy and Tesla, have been significant players in the Bitcoin market. Their decisions to buy or sell large quantities of Bitcoin can dramatically impact the market.

For instance, when Tesla announced it would no longer accept Bitcoin for payments due to environmental concerns, it contributed to a sharp decline in Bitcoin’s value.

Such actions by major corporate holders can trigger a cascade of reactions among other investors, exacerbating market volatility.

Whale Movements Before and During the Crash

Whale movements refer to the actions of individuals or entities holding large amounts of Bitcoin. Before and during the crash, significant whale movements were observed, with some whales selling off their holdings, potentially contributing to the price drop.

These large transactions can influence market sentiment, leading to a cascade of selling among other investors.

Institutional Investment Strategy Shifts

Institutional investors have begun to adjust their strategies in response to the crash. Some have diversified their portfolios to include other cryptocurrencies or assets, while others have reduced their exposure to Bitcoin.

These shifts reflect a more cautious approach, as institutional investors seek to mitigate potential losses in volatile markets.

In conclusion, institutional players have played a crucial role in the Bitcoin crash. Understanding their actions and strategies provides valuable insights into the dynamics of cryptocurrency markets.

Future Outlook: What’s Next for Bitcoin?

As the dust settles after the recent Bitcoin crash, investors are eagerly looking towards the future, wondering what’s next for the cryptocurrency.

The future outlook for Bitcoin is a complex topic, influenced by various factors including technical analysis, market sentiment, and global economic conditions.

Technical Analysis and Price Predictions

From a technical analysis perspective, Bitcoin’s price movements are being closely watched by traders and analysts. Key indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are being used to predict potential future price movements.

Some analysts believe that Bitcoin may be forming a new support level, which could potentially lead to a rebound. However, others are more cautious, pointing to the possibility of further declines if certain support levels are breached.

Potential Recovery Scenarios

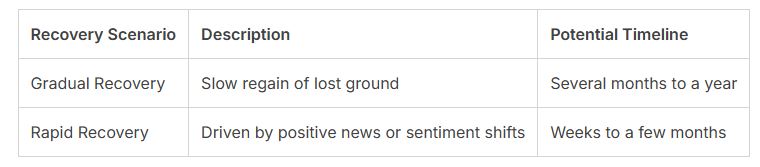

Several potential recovery scenarios are being considered by investors and analysts. One possibility is a gradual recovery, where Bitcoin slowly regains lost ground over time.

Another scenario is a more rapid recovery, driven by positive news or market sentiment shifts.

Long-term Viability Consideration

Looking beyond the immediate future, the long-term viability of Bitcoin remains a topic of discussion.

Factors such as adoption rates, regulatory environments, and technological advancements will play crucial roles in determining Bitcoin’s long-term prospects.

In conclusion, while the future of Bitcoin is uncertain, a combination of technical analysis, market sentiment, and global economic factors will shape its trajectory.

Investors should remain informed and consider multiple scenarios when making investment decisions.

Conclusion

The recent question why did bitcoin crash has left many investors and enthusiasts wondering about the causes and implications of such a significant event.

As discussed, the crash was not the result of a single factor, but rather a combination of technical, psychological, and macroeconomic elements.

A cryptocurrency market summary reveals that the crash was influenced by overleveraged positions, liquidation cascades, and regulatory pressures.

The fear and greed index played a significant role, as social media influence and retail investor panic selling exacerbated the situation.

In conclusion, the Bitcoin crash conclusion is that the cryptocurrency’s price is subject to a complex interplay of factors. Understanding these elements is crucial for investors and those interested in the cryptocurrency market.

As the market continues to evolve, it is essential to consider the potential future outlook for Bitcoin, taking into account the insights gained from this analysis.

FAQ

What caused the recent ask why did bitcoin crash?

The recent Bitcoin crash was caused by a combination of factors, including overleveraged positions, liquidation cascades, and regulatory pressures.

How does Bitcoin’s history of volatility relate to the recent crash?

Bitcoin has experienced several major crashes in the past, including the 2017-2018 bubble and burst, and the 2021 rollercoaster. Understanding these historical events can provide context for the recent crash.

What role did market psychology play in the Bitcoin crash?

Market psychology, including fear and greed, played a significant role in the Bitcoin crash. The fear and greed index, social media influence, and retail investor panic selling all contributed to the rapid price movements.

How did regulatory pressures impact Bitcoin’s price?

Recent government regulations, central bank policies, and tax implications all had an impact on Bitcoin’s price. Regulatory developments in the U.S. and internationally affected the cryptocurrency market.

What is the potential for why did bitcoin smash recovery?

Technical analysis and price predictions suggest that Bitcoin may recover, but the timeline is uncertain. Potential recovery scenarios depend on various factors, including macroeconomic conditions and institutional investment strategies.

How do macroeconomic factors influence Bitcoin’s value?

Inflation concerns, interest rate changes, and global economic uncertainty all affect Bitcoin’s price. Bitcoin’s role as a potential hedge or safe haven asset is also influenced by these broader economic factors.

What role did institutional players have in the Bitcoin crash?

Institutional players, including major corporate holders and whales, played a significant role in the Bitcoin crash. Their actions and investment strategy shifts contributed to market dynamics.

What are the long-term viability considerations for Bitcoin?

Long-term viability considerations for Bitcoin include its ability to recover from why did bitcoin crash, adapt to regulatory changes, and maintain its position as a leading cryptocurrency.

Read Next: Coin Market Cap : Cryptocurrency Prices, Charts And Market